Unique jewelry as an investment

Why is investing in gemstone jewelry always a good decision?

As a type of alternative investment, investing in art, including jewelry, has its own unique advantages and characteristics. The advantage of jewelry as an object of investment is their rarity and non-renewability, which guarantees their high value.

The relevance of investment in gemstones is explained by the awareness of the scarcity of mineral resources of the Earth, the increase in labor intensity and costs of their extraction and transportation, and the aggravation of environmental problems.

The reasons why diamonds are becoming more expensive and demand is growing

First of all, the rise in diamond prices is due to a shortage of rough diamonds.

In early 2020, the diamond market was practically paralyzed by the pandemic. Mining activity in many fields was temporarily halted. But diamond sales continued, albeit in a smaller volume.

As a result, all the stocks of stones accumulated by manufacturers, cutters and dealers were exhausted.

The diamond market is in a structural deficit: there is a high demand, but there are problems with mining. This explains the rise in prices: the market needs to reach a balance. Therefore, in 2023 the upward trend in prices will continue.

What are the advantages of investing in jewelry pieces?

1. Scarcity

This is the biggest advantage of gemstone jewelry: Mineral reserves in the earth's crust are not endless.

A limited number of high-quality jewelry demonstrates its value, which makes the market price continue to rise.

2. Preservation of high value

Once purchased, the jewelry does not depreciate, your asset is always with you and grows in value on its own

3. Easy to transport and store, there are no maintenance costs

4. Perpetuity. This is a long term investment since the precious jewelry has no limits on its shelf life

What does the price of a gemstone consist of?

There are several factors that influence the price of a gemstone. These are:

- The size of the stone;

- color;

- Internal flaws;

- cut.

The rarer the stone, the more suitable it is for investment. This applies to both the number of carats and the color.

When buying gemstones, it is important to understand that profitability depends not only on the quality characteristics of the diamond, but also on the uniqueness of the particular piece.

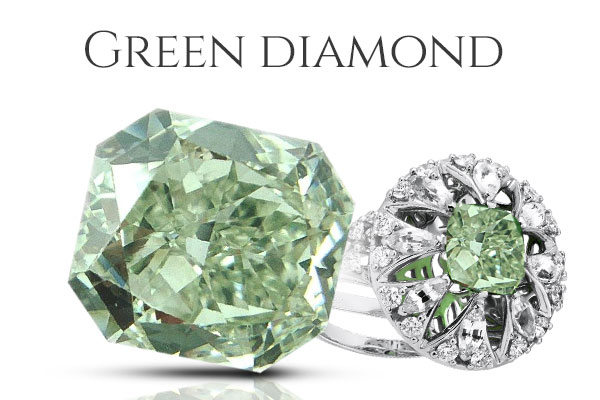

Therefore, diamonds with rare fancy colors, pink and blue, increase in value faster

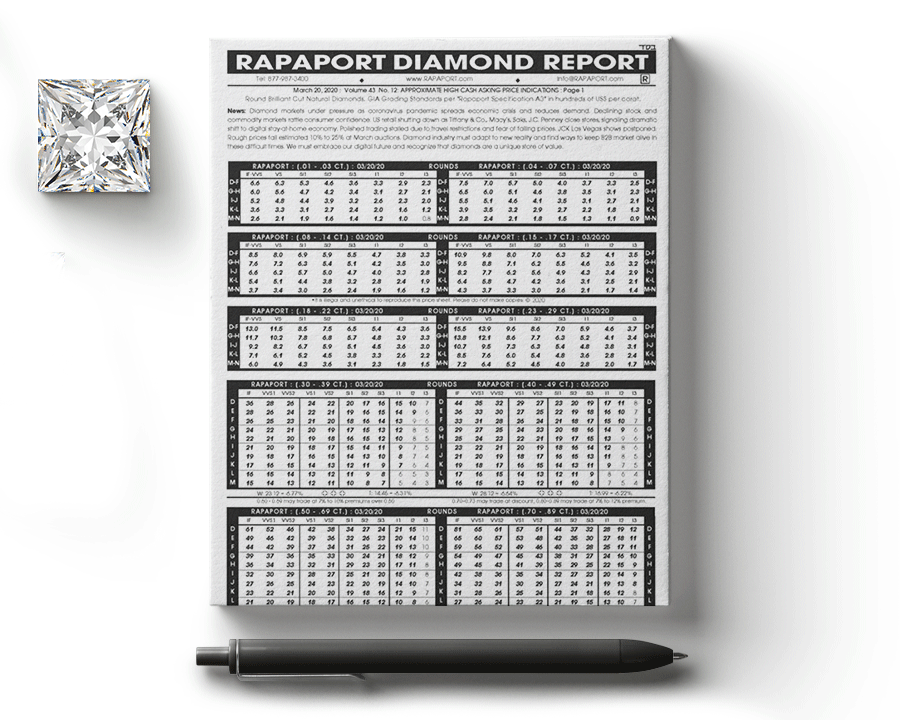

How are the prices for diamonds changing now?

Over the past 2 years, the price of diamonds at Rapaport Price increased by an average of 31%.

And prices at the exchange went up by 67%!

The reserves of minerals in the Earth's crust are not infinite.

Statistics show that every year more gems are sold and fewer are mined.The less raw material remains in the bowels of the Earth, the faster the prices go up.

Why should I invest in gemstone jewelry now?

The closer we get to the moment when the diamonds run out, the higher the price will be. First of all, diamonds and colored stones of high collector quality are at risk.

We can already see the price of diamonds rising right now by looking at the Rapaport Price Index. It reflects the average retail value of stones in the market, and now we can see that the price per carat has gone up.

Why us ?

We don't sell you a diamond. We help you buy the best one.

We work only with the highest quality natural gemstones, so we guarantee their authenticity and investment potential.

Kantor Jewelry team will be happy to provide you with the opportunity to purchase a unique and profitable investment. We will select a gemstone for you and provide you with a certificate. If our selection of stones does not satisfy you, we can offer you stones from the world gem market and will also provide you with a certificate.

Jewelry made according to your design can become a good investment and a family heirloom! Even small diamonds with average characteristics will be a profitable investment.