Diamond Foundry plans to eliminate natural diamonds from the market: An expert opinion on whether it is possible or not

In April, Forbes magazine published an article about laboratory diamonds by Diamond Foundry, in which a co-founder and CEO Martin Roscheisen ambitiously stated: "We plan to replace all natural diamond mining in five years". In this article, we will analyze how real such perspectives are and what will actually happen to the diamond market in the next few years.

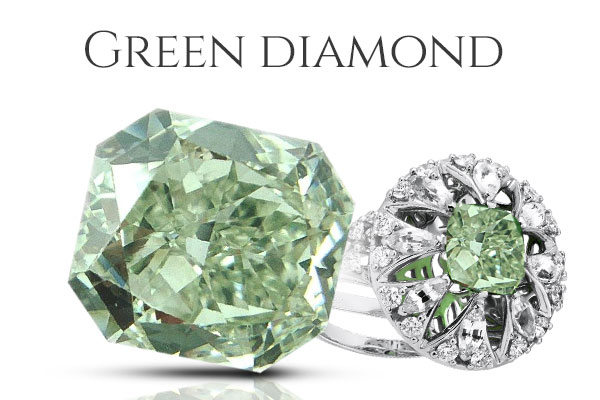

Synthetic diamonds are no longer something extraordinary on the gem market. During the past decade, they have found their unique niche, now appear on the market as a complete alternative to the natural diamonds, focusing on less wealthy customers, and emphasising environmentally friendly production and sustainability in order to win over millenials and zoomers who see no sense in overpaying for the naturalness of the diamonds mined from the earth and concern about the environment saving.

At the moment, the amount of the synthetic stones is 5% to 7% of the total gem-quality diamond market, but the growth rate of the lab-grown stones makes us to reconsider our point of view on this topic. Right now it is absolutely clear that man made diamonds are with us forever. Especially after the diamond giant De Beers began manufacturing and selling synthetic diamond jewelry under the Lightbox brand in 2018. The price per carat of such a stone is only $800, regardless of the type of the cut and characteristics of the gem.

It looks like one more try to divide the market and, first of all, to give laboratory-made stones a reputation similar to cubic zirconia: nice and affordable, but not prestigious; and second, to further increase the price gap between natural and synthetic stones to finally make it clear that only natural diamonds are truly valuable.

If we return to Martin Roschaizen's company, it has tripled the production rate of gem-quality synthetic diamonds over the past year alone, and plans to produce 20 million carats per year by 2025. This fact can lead to some concerns about the depreciation of the natural diamonds. However, in this case, it makes sense to pay attention to the market for other gems.

Other gemstone lab grown experiences

Synthetic rubies were first produced by man back in 1877 using the flux crystallization method. In the early 1900s, crystals obtained by the Verneuil method appeared, and in 1983 the Overland Gems division in California announced the availability of another flux-grown, gem-quality synthetic ruby, which became marketed under the brand name Ramaura and caused considerable concern among gemologists because of the difficulty in identifying and confusing them with the natural spices.

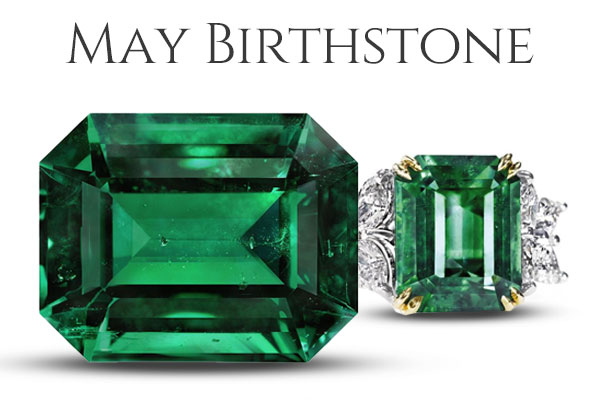

The development of the synthetic rubies could have brought down the price of natural rubies. But we see exactly the opposite picture: in the past 2 years, the prices for natural rubies with top characteristics have risen by 200%, and it's getting harder and harder to meet the demand of the customers.

The reason for this is that the natural mining locations are running out and the supply of the good quality genuine stones decreases.

Finding a ruby with a good color and clarity characteristics weighing more than one carat is becoming more and more difficult. The investment value of such species is growing every year, so does the interest in this kind of investment.

The same thing is happening with other gemstones which laboratory made counterparts are available on the market today. The production and sales of the genuine gem quality stones are reducing not due to their successful replacement by synthetics, but mostly due to the mining challenges.

So it doesn’t matter which part of the market is occupied by natural or lab-grown stones, all that matters is marketing and people’s demand.

Demand for Genuine Diamonds: Market Assessment

Within the natural diamonds market, there are also several niches where demand varies a lot. Small (0.1-0.5 carats) and medium (0.5-1 carats) stones have enough supply, while larger stones are hard to find. But in investment diamonds (from 3-5 carats and with color and clarity gvs1 and above), the demand strongly outnumbers the supply, and it may take a long time to find a desirable specimen.

Dividing the diamond market into synthetic and natural diamonds only may be correct from the perspective of a customer, but for dealers and jewelers the picture looks a little more complicated.

Lab grown diamonds can certainly compete on the market with the medium-quality diamonds weighing up to 1 carat. Customer interest can be driven to the lab grown alternatives due to the marketing campaigns promoting synthetic diamonds to lure the average buyer to their side, however there is no reason to extrapolate these trends to the entire market. Demand for the relatively large, unique pieces will persist even if the price rises.

So one of the solution for the dealers and the jewelers is to work with the premium segment of the market. This approach will let them gain a foothold in the niche where the natural origin and uniqueness of the natural stones are valued on their own merits, and diamonds are not just shiny crystals, but rather a profitable investment.

Identifying lab grown diamonds

If the marketing tricks of the companies that bring synthetic diamonds to the market do not pose a serious threat to natural stones sales, the possibility of encountering a fake one instead of the genuine can have a significant impact. The cost of the misidentification could be dramatic. Why would anyone pay several times as much for a natural diamond if it could end up being a synthetic one?

Indeed, the stories about synthetics being sold as a natural stones are common. In my own practice, I once ran into a situation while purchasing a stone through an intermediary: a natural diamond with top-notch characteristics turned out to be a lab-made one.

However, it is worth understanding that most fraud occurs in large batches of small diamonds (mele) weighing a tenth of a carat, because they often do not go through a thorough examination.

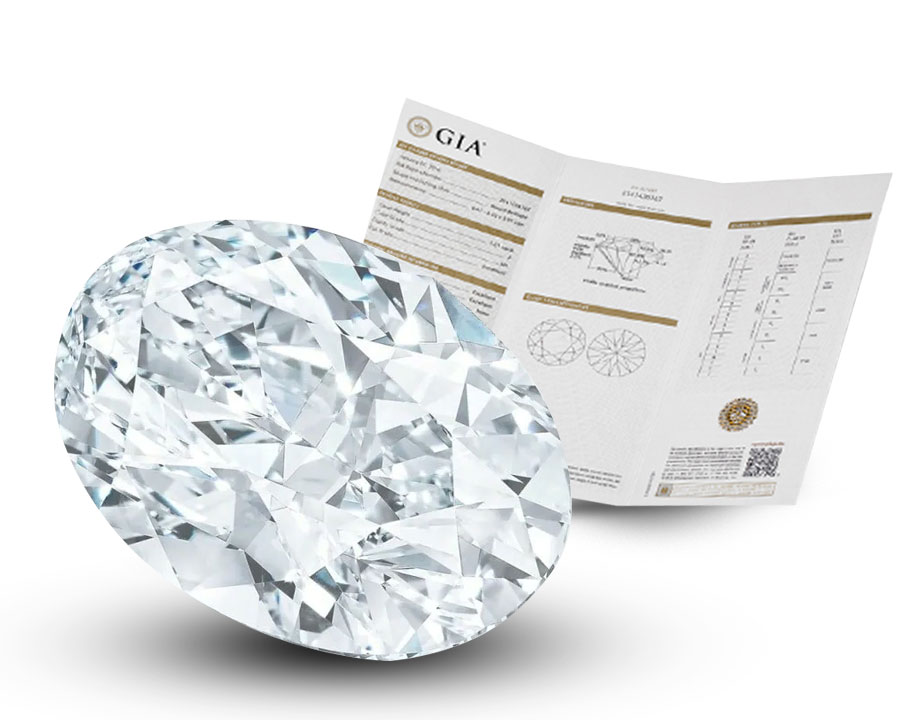

Nowadays, there is only one guaranteed way to distinguish a synthetic diamond from a natural one: the evaluation by a gemological laboratory, such as the internationally recognized GIA or the Gemological Laboratory of Moscow State University in Russia. The more synthetic diamonds are distributed worldwide, the higher the risk of getting a lab-grown stone confused with a natural unique specimen.

Neglecting to check batches of small stones by dealers or favoring less reputable and cheaper labs increases the risk that some of these diamonds will actually be synthetics. Also it can lead to the undermining consumer confidence and further reducing the value of a natural stone in a given segment.

So there are two possible scenarios of the development. Either there will be more serious control over the authenticity verification of the small diamonds, or they will gradually start to be replaced on the market by synthetics.

But what is absolutely certain is that the niche of investment diamonds will not suffer from the growth rate of laboratory counterparts and will maintain its demand for the next few years.

Kantor Jewelry is focused on authenticity, rarity, uniqueness and value, so we work only with genuine stones and create one-of-a-kind jewelry with customised design. We don’t buy stones wholesale, we look for the best, most beautiful and profitable personal option for our clients. We seek out special stones upon your request until you are satisfied with the quality.

If you have not found a stone that works for you in our stock, then we can find the gem you would fall in love with on the world gemstone market. After you choose a gemstone, our team will help you to create a customized jewelry design.

Our team will help you to find the best setting option for your gemstone so it can please you with its beauty for many years as a part of a unique jewelry piece that will pass down from generation to generation.